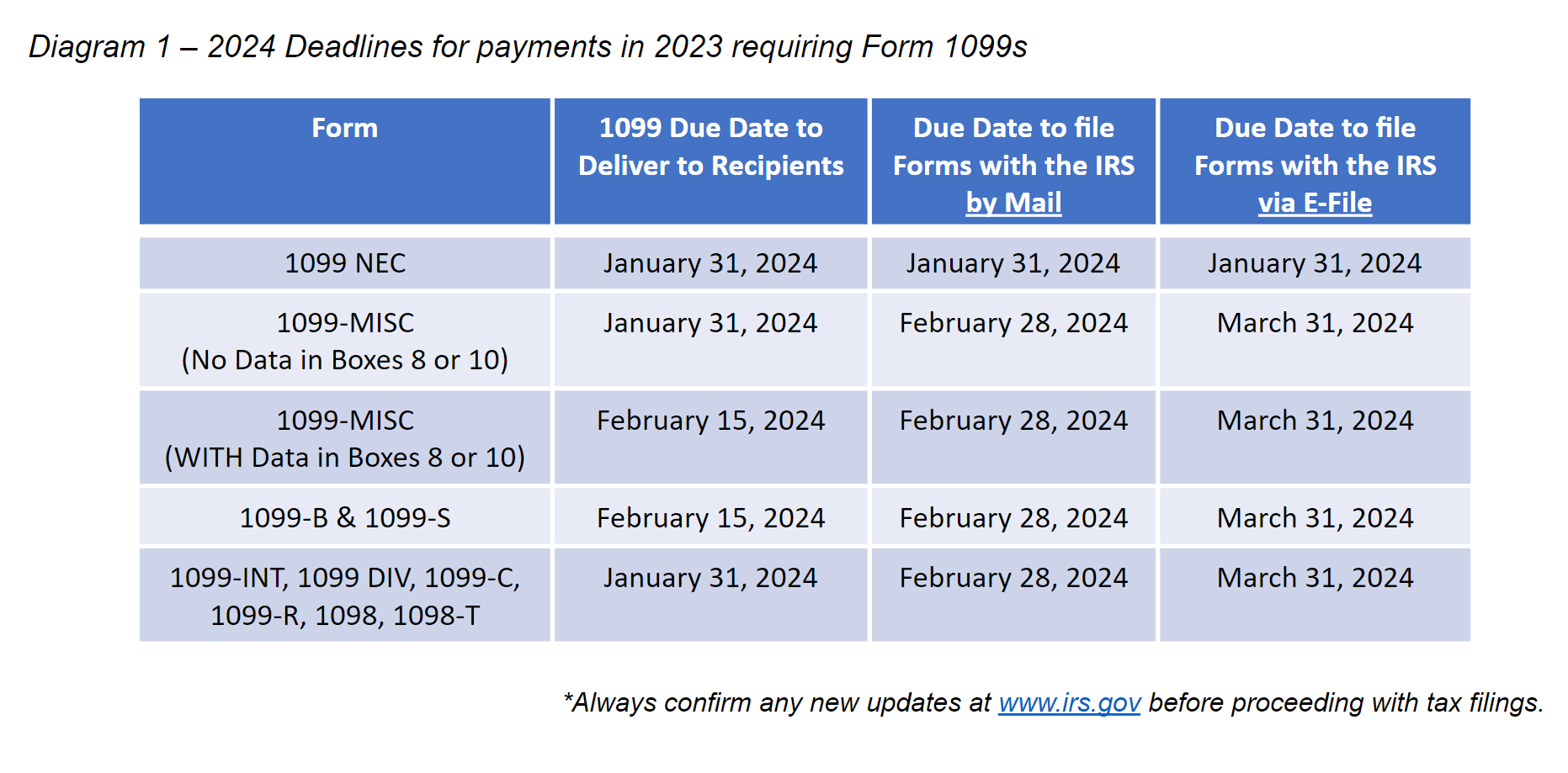

1099 Deadline For 2024 – It’s tax time. Here’s a look at what you need to know about due dates for your tax forms, including Forms W-2 and 1099, and what to do if you don’t receive yours on time. . Federal income tax returns are due on April 15, but there are several other important dates to remember throughout the year. .

1099 Deadline For 2024

Source : blog.checkmark.com

Business tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com

1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com

2023 1099, W 2 & ACA Filing Deadlines to the IRS and SSA – CUSTSUPP

Source : support.custsupp.com

How to File 1099 NEC in 2024 — CheckMark Blog

Source : blog.checkmark.com

Tax Filing Deadline Dates 2024

Source : www.fusiontaxes.com

1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com

1099 Rules for Business Owners in 2024 Mark J. Kohler

Source : markjkohler.com

1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com

IRS Form 1099 NEC Due Date 2024 | Tax1099 Blog

Source : www.tax1099.com

1099 Deadline For 2024 How to File 1099 NEC in 2024 — CheckMark Blog: By law, the IRS must wait until mid-February to issue refunds to taxpayers who claimed the earned income tax credit or additional child tax credit. According to the agency, those payments should be . As the calendar turns over to a new year, taxes may be the last thing on your mind. But part of your annual financial review should always include a look at upcoming tax deadlines so you can avoid .